ETH Price Prediction: Navigating the $4,000 Crossroads

#ETH

- Technical Support Test: ETH is currently testing the critical $4,000 support level with Bollinger Bands indicating potential oversold conditions

- Mixed Market Sentiment: Whale accumulation and institutional adoption contrast with technical breakdown warnings and protocol issues

- Momentum Indicators: MACD remains bullish despite price pressure, suggesting underlying strength may support a rebound

ETH Price Prediction

ETH Technical Analysis: Critical Support Test at $4,000

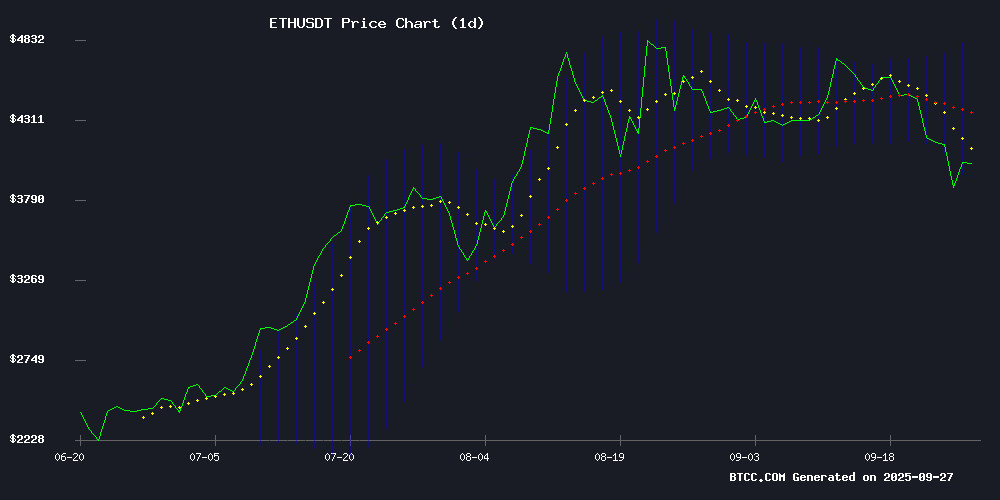

Ethereum is currently testing crucial technical levels as price hovers around $4,016.53. According to BTCC financial analyst William, the 20-day moving average at $4,372.21 suggests resistance overhead, while the MACD reading of 152.27 indicates bullish momentum remains intact despite recent pullbacks.

William notes that Bollinger Band positioning shows ETH trading NEAR the lower band at $3,915.34, which often signals potential oversold conditions. 'The $4,000 level represents a psychological and technical battleground,' William states. 'A sustained break below could see testing of the $3,500 support zone, while holding above may trigger a rebound toward the middle Bollinger Band at $4,372.'

Market Sentiment Mixed as Ethereum Faces Key Juncture

Recent news FLOW presents a conflicting picture for Ethereum's near-term trajectory. BTCC financial analyst William observes that while whale accumulation of 406,000 ETH and institutional adoption through SWIFT's Consensys partnership provide bullish catalysts, technical breakdown warnings and the R2 Protocol account suspension create headwinds.

'The Fusaka testnet completion and Glamsterdam upgrade progress demonstrate strong fundamental development,' William comments. 'However, market sentiment remains cautious as price tests the critical $4,000 support level. The balance between institutional adoption and technical concerns will likely determine short-term direction.'

Factors Influencing ETH's Price

Ethereum’s $4,000 Support: A Pivotal Moment for Price Trajectory

Ethereum stands at a critical juncture as its $4,000 support level becomes the focal point for traders. The cryptocurrency, currently trading at $4,024 with a 3.1% daily gain, faces mixed signals: a 25.12% drop in trading volume contrasts with its historical resilience during similar technical patterns.

Analyst FOUR Crypto Spaces identifies this as the third bounce point in ETH's recurring trend cycle—a pattern that previously preceded substantial rallies. Market sentiment hinges on whether the $4,000 floor holds. A breach could trigger accelerated upside, while failure may invite prolonged consolidation.

Despite a 10.06% weekly decline, Ethereum's dominant market position and growing institutional interest suggest underlying strength. The current volatility reflects typical market thermodynamics—bearish pressure often giving way to bullish reversals in established assets.

Ethereum Whale Activity Drives Price Shifts in September 2025

Ethereum plunged below $4,000 for the first time in nearly seven weeks, touching $3,965 on September 25 amid heightened market volatility. The drop triggered $134 million in long liquidations, with one trader losing $36.4 million in a single position. Whales are actively reshaping the market landscape through strategic accumulation and distribution.

The asset has shed 12.4% over the past week, briefly recovering to $4,032 by midday. Leveraged positions amplified the sell-off, with Coinglass data showing $140 million in total liquidations during the downturn. Market makers appear to be testing key support levels as open interest fluctuates.

Ethereum Faces Potential Pullback to $3,500 as Analysts Flag Technical Breakdown

Ethereum's price trajectory is under scrutiny as analysts warn of a potential retreat to the $3,500 range. Dan Gambardello highlights a triangle pattern breakdown on the daily chart, signaling a likely test of the 20-week moving average confluence near $3,500-$3,600. The setup aligns with expectations of a "throwback"—a healthy consolidation phase typical in market cycles.

Technical weakness appears more pronounced in ETH compared to peers like Cardano, which maintains stronger proximity to support levels. Critical watchpoints include the $4,060 support zone identified by analyst Ted, now serving as a litmus test for recovery potential. Market participants are weighing whether this correction represents a buying opportunity or the start of deeper downside.

Ethereum Price Prediction: Next Stop $20K? Possible Says Analyst

Exchange balances for Ethereum have plummeted to a nine-year low, with only 14.8 million ETH remaining on trading platforms. Digital asset treasury firms and exchange-traded funds are aggressively accumulating, diverting supply away from exchanges.

Market sentiment is intensifying as Ethereum tests critical resistance levels. Analyst Cantonese Cat suggests ETH could rally fivefold from its current $3,955.46 price to $20,000, citing historical cycle patterns where liquidity zones precede explosive advances.

The asset now faces a decisive technical confluence—an ascending support trendline meeting horizontal resistance. A breakout above this zone may confirm the start of Ethereum's next major upward phase.

Ethereum Developers Finalize Fusaka Testnet Rollout, Eye Glamsterdam Upgrade

Ethereum developers have cemented the testnet schedule for the Fusaka upgrade, marking a critical step toward mainnet activation. The Holesky testnet will initiate the rollout on October 1, followed by Sepolia and Khudai at two-week intervals. Blob parameter optimizations will deploy one week after each testnet's Fusaka activation, per Meta EIP-7607.

The upgrade coincides with rising blob usage, now nearing the network's target capacity. Base and Worldcoin dominate two-thirds of blobspace consumption, with Base alone claiming 42%. Vitalik Buterin addressed validator concerns, emphasizing Fusaka's prioritization of safety and its PeerDAS solution for storage and MEV inefficiencies.

Developers also greenlit a gas limit increase to 60 million and advanced preliminary plans for the subsequent Glamsterdam hard fork. A proposal to formalize EIP champions signals growing structural maturity in Ethereum's governance.

Ethereum Tests Key Support Level Amid Historic Whale Activity

Ethereum faces a pivotal moment as its price hovers near the $3,933 support level, with market participants awaiting a decisive breakout or breakdown. A breach above $4,060 could catalyze a significant upward move, while failure to hold current levels may trigger further downside.

Two dormant wallets liquidated 200,000 ETH worth $788 million, realizing historic gains from initial purchases at $50 per token. This substantial profit-taking event marks one of the largest single exits in Ethereum's history.

The second-largest cryptocurrency by market cap currently trades at $3,940, reflecting a 1.46% decline over the past 24 hours. Trading volume remains robust at $63.61 billion as investors monitor these critical technical levels.

Swift Selects Consensys' Linea for Blockchain-Based Interbank Messaging Pilot

Swift has partnered with Consensys-developed Ethereum Layer-2 network Linea to test blockchain-based interbank messaging, marking a significant shift from its traditional centralized infrastructure. The multi-month pilot involves major banks including BNP Paribas and BNY Mellon, with plans to examine both messaging transitions and stablecoin integration.

Linea's native token surged 10.6% immediately following the announcement, reflecting market optimism about institutional blockchain adoption. This initiative follows Swift's September 2024 digital asset roadmap, which targeted the $30 trillion tokenized asset market through Delivery-versus-Payment and Payment-versus-Payment transaction testing.

The selection of Linea underscores Ethereum's growing institutional credibility, with Swift specifically citing the network's transaction capabilities as key differentiators. Banking sources describe the project as potentially transformative for cross-border payments, though full implementation remains months away.

Ethereum Price Prediction: $6,009 In Sight As Whales Accumulate 406K ETH

Ethereum's price action is mirroring a historical pattern of sharp declines followed by explosive rallies, according to crypto analyst Kamran Asghar. The current setup suggests a potential surge toward $6,000, bolstered by aggressive accumulation from large investors.

On-chain data reveals 15 whale wallets purchased over 406,000 ETH within two days, totaling $1.6 billion. This aligns with technical indicators showing 64.72% and 37.25% gains in July and August after similar pullbacks.

The combination of whale activity and cyclical price movements creates conditions for what could be Ethereum's next major breakout. Market observers note these patterns resemble calculated shakeouts before sustained upward momentum.

SWIFT and Global Banks Test Blockchain Messaging on Consensys’ Linea

SWIFT has mobilized a consortium of major financial institutions, including BNY Mellon and BNP Paribas, to experiment with migrating its core messaging system onto Consensys’ Ethereum layer-2 solution, Linea. The initiative builds on SWIFT’s 2023 tokenization trials and aligns with broader digital asset testing planned for 2025.

The project, described as a precursor to a transformative shift in interbank payments, prioritizes privacy through advanced cryptographic proofs—a critical feature for meeting banking compliance standards. A successful rollout could streamline cross-border payments, reduce costs, and accelerate settlement times.

Linea’s selection underscores the growing institutional demand for scalable, compliant blockchain infrastructure. The test signals deepening collaboration between traditional finance and decentralized technology, with implications for Ethereum’s ecosystem and broader adoption of layer-2 solutions.

Ethereum Bearish Trend Deepens as Price Tests $4,000

Ethereum faces intensified selling pressure as its price struggles to maintain critical support levels. The cryptocurrency failed to sustain gains above $4,150, slipping into a renewed decline that now threatens the $4,050 and $4,000 zones.

The bearish structure emerged after ETH broke down from the $4,450 region, mirroring Bitcoin's recent cooling-off period. Trading below its 100-hourly Simple Moving Average at $4,100, Ethereum shows clear signs of bearish dominance.

Attempts to recover faltered at $4,250, with resistance forming a strong cluster between $4,220 and $4,250. A decisive close above $4,150 appears necessary for any meaningful recovery.

R2 Protocol's X Account Suspended Following Mainnet Launch

R2 Protocol, a decentralized yield platform for real-world assets, faced an unexpected setback as its X account was suspended shortly after its Ethereum mainnet launch on September 26, 2025. The platform, which aims to democratize access to off-chain yield through its R2USD stablecoin, had garnered significant attention with over 154,000 participants attracted by its early rewards program.

The suspension comes amid user complaints regarding USDC deposits for accessing mainnet rewards. X's policy indicates account suspensions occur due to rule violations, though the specific reason remains unclear. The protocol's innovative approach—tokenizing U.S. Treasuries and private credit vaults—had driven its total value locked to notable levels post-launch.

Will ETH Price Hit 4000?

ETH is currently trading at $4,016.53, essentially at the $4,000 level in question. The more relevant consideration is whether it will maintain or break below this critical support.

| Indicator | Current Value | Implication |

|---|---|---|

| Current Price | $4,016.53 | Testing key support |

| 20-day MA | $4,372.21 | Resistance overhead |

| Bollinger Lower Band | $3,915.34 | Next support level |

| MACD | 152.27 | Bullish momentum intact |

According to BTCC financial analyst William, 'ETH has already reached $4,000 and is now battling to maintain this level. The technical setup suggests this represents a pivotal moment where either a rebound toward $4,372 or a breakdown toward $3,500 could unfold in the coming sessions.'